Global Markets

BNP Paribas’ Global Markets offers consistent client service and innovative solutions for investment, hedging and financing opportunities across asset classes and geographies, and research and market intelligence to help our clients make strategic decisions.

Global Equities

BNP Paribas’ long-established record in equity derivatives, along with the migration of Deutsche Bank’s Global Prime Finance and Electronic Equities business and the acquisition of Exane, positions the bank as a leading provider in Global Equities. The three complementary businesses – equity derivatives, prime services and cash equities research and execution, work together to provide clients with the full spectrum of equity-based services to fulfil their investment, financing and execution objectives.

Cash Equities

A premier platform in Electronic Execution via Cortex Equities, Portfolio Trading, High Touch and ETFs, accessing diverse liquidity pools across global equity markets.

Clients have access to Quant Research, Execution Consulting and Market Structure analysis. In addition, we offer top-ranked independent, fundamental equity research globally, along with corporate access and corporate broking services.

Prime Services

A fully-integrated global cash and synthetic prime brokerage platform, leveraging on BNP Paribas’ top-tier balance sheet and expertise.

Our offering includes multi-asset structured financing solutions; global market access, financing and execution across Delta One products (ETFs, custom baskets…) and Capital Introduction services.

Our quantitative and systematic platform delivers best-in-class execution and algorithmic trading.

Equity Derivatives

A global leader in structured products for distribution and institutional clients. We are a transparent liquidity provider in the flow business across various solutions such as options and volatility derivatives.

As a strategic equity partner for corporates, we provide bespoke equity derivatives-based solutions.

We have a strong track record in designing Quantitative Investment Strategies (QIS) solutions.

Our award winning digital platforms include Smart Derivatives and Brio.

Global Credit

Our global Credit business enables us to realise synergies while maintaining strict boundaries between the public and private sides. We provide solutions to clients throughout the entire credit continuum from origination through execution to secondary market trading and post trade services.

Global Issuance Base

True global markets access

Our global presence enhances our abilities in complex, multi-market and multi-currency issuance. We are number one bond book runner regarding EMEA activity and euro bond issuance, a lead arranger in Asian and American bond markets, providing seamless execution and distribution for issuers looking to access both international and local markets. We are also one of the few foreign banks with a non-financial corporate bonds underwriting license in China.

Global Macro

Global Macro offers the full spectrum of products across FX, Rates and Commodities in both developed and emerging markets, from millisecond electronic trading supported by the most advanced AI platforms, through to long dated, high touch solutions.

Foreign Exchange

Our Forex business is designed to respond to the complex and constantly evolving market. Discover our truly global network boasting broad market access across both developed and emerging markets.

Global Rates

We aim to be a top 3 house across both developed and emerging market rates. Our business has grown substantially and we operate a culture of “shared purpose”. Our focus is aligned around the social and economic outcomes of supporting our broad client base across Corporates and Institutional Investors.

Commodity Derivatives

With a global footprint and over 30 years of expertise in the commodities market, we are one of the few banks in the world with a long term commitment to the growth of our commodity derivatives franchise bringing innovative and ground breaking solutions to clients worldwide.

Why Us?

- Market maker in the entire suite of forex, local rates and G10 rate products permitted in India.

- Strong and seasoned research set-up.

- Onshore sales supported by a regional sales team in Hong Kong and Singapore, distributing the India offering.

- Amongst the top brokers by trading volume in in the top-200 stocks (2021 Bloomberg data).

- Awarded top 3 derivatives houses in India on 25th anniversary of the NSE this year.

- Ranked among the leading foreign banks for primary capital raise across products – qualified institutional placement (QIP), Rights and foreign currency convertible bonds (FCCBs) in 2020-21.

- Award-winning digital multi-product forex trading platform – Cortex.

- #1 Globally on all sustainable bonds (Corp/FIG/SSA) and #4 in APAC on all ESG bonds.

Our Platforms

Cortex FX

Cortex FX is our advanced multi-product forex trading platform. Whether you want to develop innovative trading strategies, execute trades or monitor and evaluate your trading activity, Cortex FX – an award winning platform – offers a fully-integrated trading environment that is simple to use, giving you the freedom to concentrate on taking advantage of every trading opportunity.

ALiX – your digital trading assistant

ALiX has the full power of Cortex FX in a conveniently small window on your desktop. ALiX is indisputably pixel-for-pixel the most powerful FX platform on the market. Understanding everything from a spot ticket to a complex option ALiX is there to save you both screen space and time.

Important Information for Clients

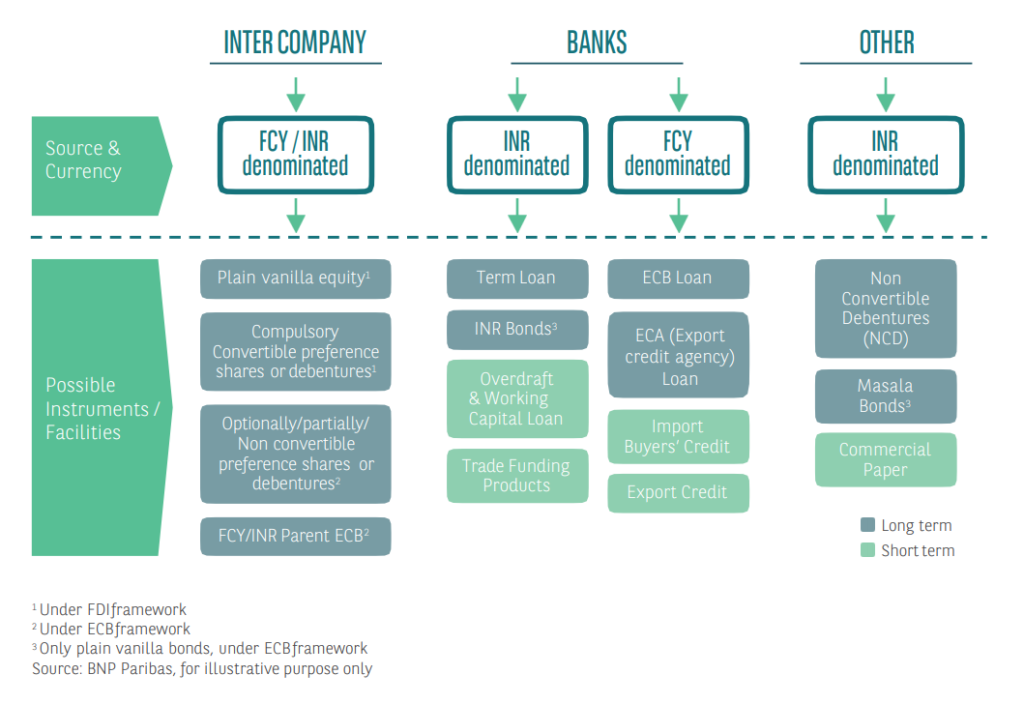

- A quick overview of financing options in India

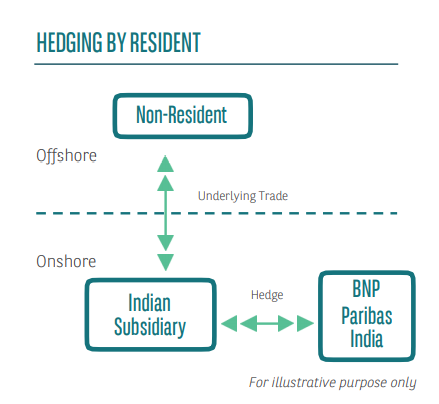

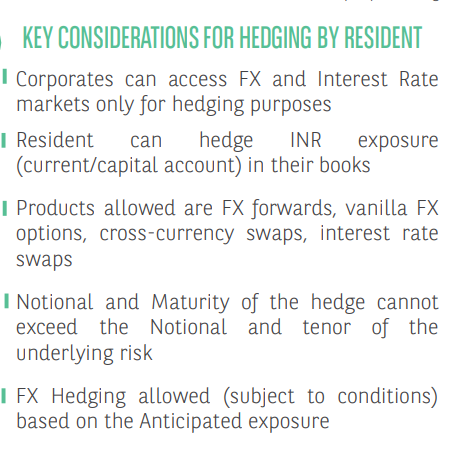

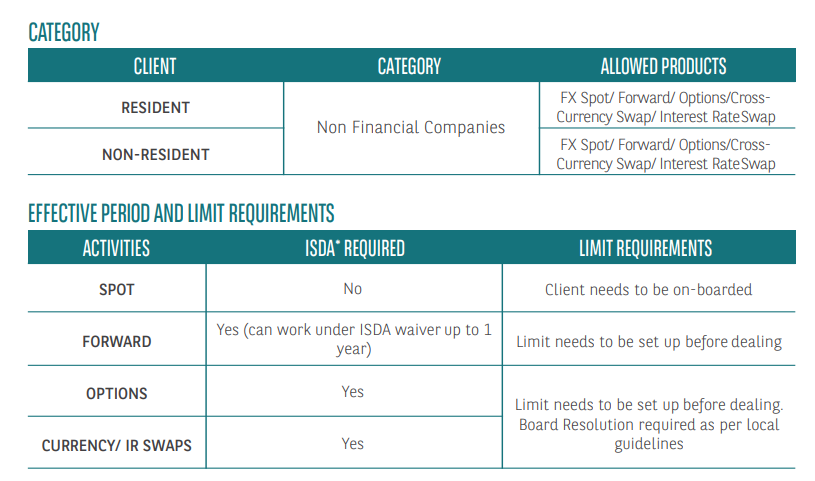

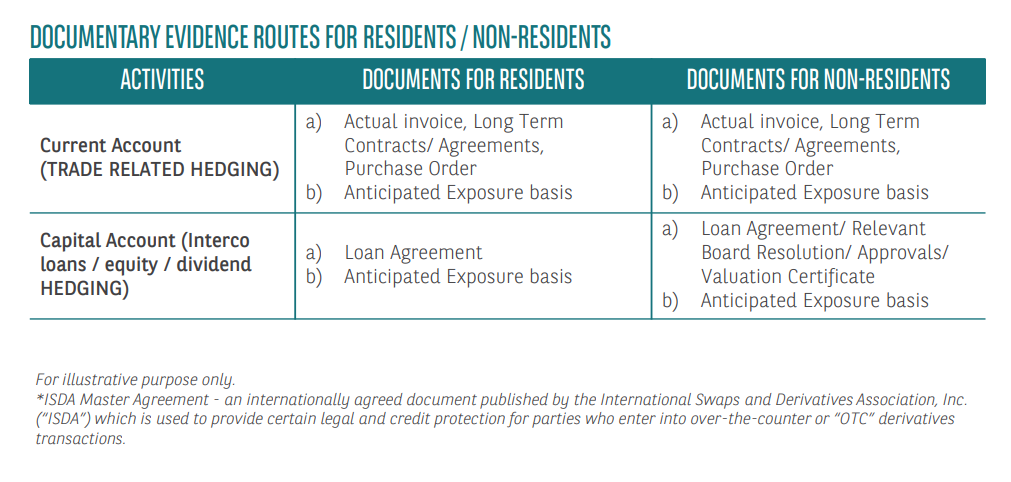

- Hedging options for residents

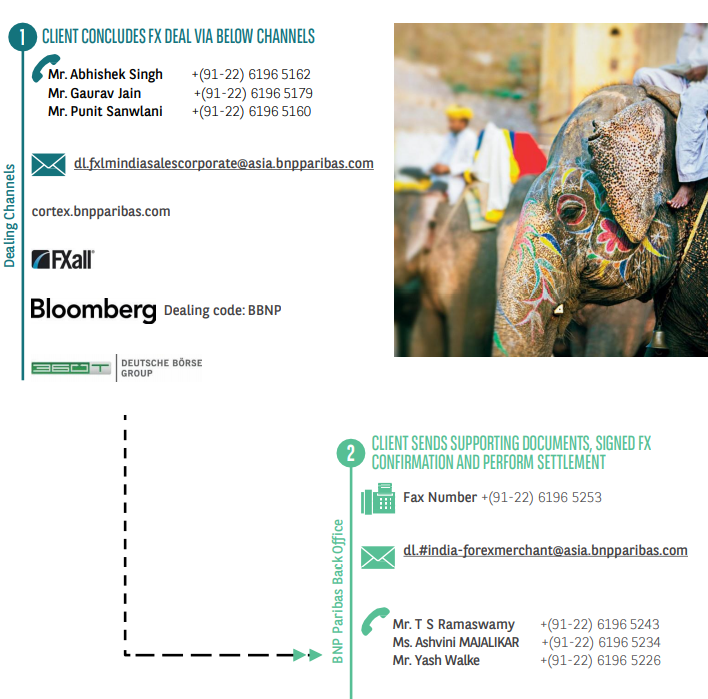

- Onshore dealing highlights

- Documents and more

- Key contacts

A quick overview of financing options in India

Please note:

- FDI Framework: Investments can be made in shares, mandatory and fully convertible debentures and mandatory and fully convertible preference shares of an Indian company by non-residents through Approval OR Automatic Route.

- ECB Framework: Rules prescribed by RBI for borrowing in India from offshore lenders. Guidance provided on tenor, pricing, end use amongst other things under this framework.

- Withholding tax to be priced in on offshore lending with ECB and Masala bonds currently subject to a 5% WHT.

- As ECB and NCD rules have converged, more corporates seem to again be opting for the ECB route. Masala bonds are a new revenue, but require creating a listed instrument.

- Onshore lending is governed by Single Borrower limits.

Key Parameters of the INR Hedging Markets

On Shore dealing highlights

Key contacts