Important Communication

In our continuous endeavor to provide enhanced banking services and adherence to applicable RBI regulations (Master Circular on Customer Service in Banks RBI/2015-16/59 DBR No.Leg.BC. 21/09.07.006/2015-16 dated July 1, 2015), we would like to reiterate & bring your attention to information available on our website w.r.t. our standard schedule of charges.

With effect from 16th June 2023, our updated standard schedule of charges shall be applicable. You may review this updated schedule here

Pricing for our specialized services, if any, pre-agreed as per our offer letter remain unchanged.

Please get in touch with our Client Services Team at (csd_mumbai@asia.bnpparibas.com / csd_delhi@asia.bnpparibas.com) or call at our toll free number 18002677766 or your Transaction Banking Sales manager for any further information in this regard.

In these unprecedented circumstances, which first responders, patients, families and businesses face with courage, we strongly recommend that you do not lower your guard against fraud and cyber threats. Fraudsters and hackers are increasingly active; seeing opportunities to attack fragile businesses and organisations, exploiting the on-going crisis to carry out fraudulent attacks. please refer to the attached document on Fraud & Cyber Risks – Awareness kit for more information. This kit contains examples of frauds, warning signs that should alert them, videos and articles to learn more, as well as concrete tips to protect against fraud and cyber-attacks.

Cybercriminals will often use the branding of “trusted” organizations in these phishing attacks, especially the World Health Organization (WHO) and U.S. Centres for Disease Control and Prevention (CDC), in order to build credibility and get users to open attachments or click on the link.

Please immediately contact your Transaction Banking Sales Manager to report any such instance that you may come across. Alternatively, please write us at csd_mumbai@asia.bnpparibas.com/ csd_delhi@asia.bnpparibas.com or call us at our toll free line 1800 267 7766 on working days, between 9.30 am and 6.30 pm.

In our continuous endeavor to provide superior banking services and in accordance with RBI circular dated September 25, 2020 (RBI/2020-21/41 DPSS.CO.RPPD.No.309/04.07.005/2020-21), we are pleased to extend Positive Pay Service for Cheque Truncation System from January 1, 2021.

Under Positive Pay, you (cheque issuer) can submit certain minimum cheque details with us (drawee bank), which will be compared with the cheque presented during clearing. Kindly note that as per RBI circular only those cheques which follow the Positive Pay procedure will be accepted under dispute resolution mechanism at CTS grids. Please refer to the RBI circular dated September 25, 2020 (RBI/2020-21/41 DPSS.CO.RPPD.No.309/04.07.005/2020-21) for further details.

Effective January 1, 2021, Positive Pay shall be enabled by default for all clients on our internet banking platform (NETPAY) who have subscribed to Cheque Service. All other clients are requested to reach out to our Client Services Team / Transaction Banking Sales Manager for activating Positive Pay. Additional T&Cs shall apply to clients using Positive Pay.

Please get in touch with our Client Services Team at (csd_mumbai@asia.bnpparibas.com / csd_delhi@asia.bnpparibas.com) or your Transaction Banking Sales Manager for any further information in this regard

We are pleased to offer the NEFT and RTGS facility to our customers as follows:

- All Incoming and Outward NEFT and RTGS transactions to your BNP Paribas accounts will be received and processed on a 24×7 basis.

- All Outward NEFT and RTGS transactions initiated and confirmed by you through our electronic banking channel up to 23.00 IST will be immediately debited from your BNPP account and sent to clearing for processing on the same day.

Below transaction limits will be applicable for outward NEFT, RTGS transactions initiated and confirmed by you through our electronic banking channel outside business hours and on bank holidays

| Transaction limits for Outwards NEFT & RTGS | 20.30 hrs – 05.59 hrs IST on working days | 2nd & 4th Saturday, Sunday and Bank holidays |

| Maximum transaction limit | INR 10 Lakh | INR 10 Lakh |

Note:

- Outward NEFT and RTGS transactions submitted through our electronic banking channel between 23.01 IST to 23.59 IST will be processed the next day

- Once the amount is debited and sent to clearing for processing, the credit to the beneficiary account is subject to processing time taken at the destination bank

- The minimum transaction limit amount of INR 2,00,000 for RTGS transactions will continue to apply

Please get in touch with our Client Services Team at (csd_mumbai@asia.bnpparibas.com / csd_delhi@asia.bnpparibas.com) or your Transaction Banking Sales manager for any further information in this regard

NEW TDS RULE – section 206AB of income tax act, 1961 – effective July 1, 2021

In connection with the newly introduced section 206AB of the Income-tax Act, 1961 (Act), applicable with effect from 1 July 2021. As per the said section, where tax is required to be deducted at source (TDS) under any of the provisions of Chapter XVIIB of the Act (which encompasses the TDS sections) (except where tax required to be deducted at source under sections 192, 192A, 194B, 194BB, 194LBC or 194N of the Act) at the time of payment or credit to ‘specified person’ (deductee), such tax shall be deducted at higher of the following rates;

- Twice the rate specified in the relevant provision of the Act

- Twice the rate or rates in force; or

- 5 percent

TDS at the rates prescribed by section 206AB of the Act (as stated above) shall be done where payment or credit is made to ‘specified person’ i.e. both of the below mentioned conditions are satisfied;

- The deductee has not filed it’s return of income for both of the two financial years immediately preceeding the financial year in which TDS is required to be done and for which the time limit for filing a return of income under section 139(1) has expired; and

- The aggregate of TDS and tax collected at source (TCS) in case of such deductee for each of the above two financial years is Rs 50,000 or more

In light of the above, for the purpose of determining the applicability or otherwise of section 206AB of the Act in your case, we request you to kindly reply to this email confirming:

- That you have filed the return of income in India for at least one of the two financial years immediately preceding the financial year in which the tax is required to be deducted, and for which the time limit for filing return of income prescribed under section 139(1) of the Act has expired,

- (in case of non-resident deductee only) That you do not have a Permanent Establishment in India during the previous year (PY), i.e. 2021-22, and

- That in the event there is any income tax demand (including interest or penalty) on BNP Paribas Group Entities on account of placing reliance on this confirmation, we undertake to indemnify and pay such sums and authorize BNP Paribas Group Entities to recover said sums from monies due.

We request you to provide this email confirmation latest by 30th June, failing which effective 1st July we shall deduct TDS at the rate prescribed under section 206AB of the Act.

Please get in touch with our Client Services Team at (csd_mumbai@asia.bnpparibas.com / csd_delhi@asia.bnpparibas.com) or call at our toll free number 18002677766 or your Transaction Banking Sales manager for any further information in this regard.

Legal Entity Identifier Code for participation in non-derivative markets

Please note that Reserve Bank of India had mandated the requirement of Legal Identity Identifier(LEI) vide notification no. RBI/2018-19/83 FMRD.FMID.No.10/11.01.007/2018-19 dated November 29, 2018 for any non-derivative forex transactions(i.e. transactions that settle on or before the spot date) involving an amount equivalent to or exceeding USD one million or equivalent thereof in other currencies. This has been implemented in phased manner as per below schedule:

Schedule for Implementation of LEI in the Money market, G-sec market and Forex market

| Phase | Net Worth of Entities | Proposed deadline |

| Phase I | above Rs.10000 million | April 30, 2019 |

| Phase II | between Rs.2000 million and Rs 10000 million | August 31, 2019 |

| Phase III | up to Rs.2000 million | March 31, 2020 |

We would like to reiterate and highlight that Deadline for Phase III is on 31 March, 2020 and approaching fast.

The LEI system has been implemented in a phased manner for participants (other than individuals) in the over-the-counter markets for rupee interest rate derivatives, foreign currency derivatives and credit derivatives in India in terms of RBI circular FMRD.FMID No. 14/11.01.007/2016-17 dated June 1, 2017 and for large corporate borrowers of banks in terms of RBI Circular DBR.No.BP.BC.92/21.04.048/2017-18 dated November 2, 2017.

Your organization can obtain LEI from any of the Local Operating Units (LOUs) accredited by the Global Legal Entity Identifier Foundation (GLEIF) (https://www.gleif.org/en). In India LEI code may be obtained from Legal Entity Identifier India Ltd. (LEIL) (https://www.ccilindia-lei.co.in). The rules, procedures and documentation requirements may be ascertained from LEIL (https://www.ccilindia-lei.co.in/USR_FAQ_DOCS.aspx).

Lapsed LEI codes shall be deemed invalid for transactions in markets regulated by RBI & any non-derivative forex transactions involving an amount equivalent to or exceeding USD one million or equivalent thereof in other currencies, shall not be entertained.

Kindly refer to below link for the detailed RBI regulation on applicability of Legal Entity Identifier (LEI) & share your LEI with your Relationship Manager for our records, at the earliest:

https://rbidocs.rbi.org.in/rdocs/Notification/PDFs/NT8365250BB4E43B466BBDCA941515498FBB.PDF

As per the RBI circular dated January 5, 2021 (RBI/2020-21/82 DPSS.CO.OD No.901/06.24.001/2020-21) introducing LEI system (Legal Entity Identifier) for all transactions of value INR 50 crore and above undertaken by entities (non-individuals) using NEFT and RTGS effective April 1, 2021

The Legal Entity Identifier (LEI) is a 20-digit number used to uniquely identify parties to financial transactions worldwide. It was conceived as a key measure to improve the quality and accuracy of financial data systems for better risk management post the Global Financial Crisis. LEI has been introduced by the Reserve Bank in a phased manner for participants in the over the counter (OTC) derivative and non-derivative markets as also for large corporate borrowers

In accordance to the RBI circular, it is hereby advised to entities who undertake large value transactions (INR 50 crore and above) using NEFT and RTGS to obtain LEI in time, if they do not already have one. Effective April 1, 2021, for RTGS/NEFT transactions of value INR 50 Crore and above, if remitter / beneficiary LEI number is not present, transaction may not be processed (debits and credits)

Entities can obtain LEI from any of the Local Operating Units (LOUs) accredited by the Global Legal Entity Identifier Foundation (GLEIF), the body tasked to support the implementation and use of LEI. In India, LEI can be obtained from Legal Entity Identifier India Ltd. (LEIL) (https://www.ccilindia-lei.co.in), which is also recognised as an issuer of LEI by the Reserve Bank under the Payment and Settlement Systems Act, 2007

We shall update you on the process of sharing LEI information with us in due course of time. Please get in touch with our Client Services Team at (csd_mumbai@asia.bnpparibas.com / csd_delhi@asia.bnpparibas.com) or your Transaction Banking Sales Manager for any further information in this regard

“Dear Customer,

Kindly refer RBI circulars DOR.No.BP.BC/7/21.04.048/2020-21 dated August 6, 2020 and RBI/2020-21/79DOR.No.BP.BC.30/21.04.048/2020-21 dated December 14, 2020 regarding opening of current accounts

On a review, RBI has permitted banks to open specific accounts which are stipulated under various statutes and instructions of other regulators/ regulatory departments, without any restrictions placed in terms of the above-mentioned circular dated August 6, 2020. An indicative list of such accounts is as given below:

- Accounts for real estate projects mandated under Section 4 (2) l (D) of the Real Estate (Regulation and Development) Act, 2016 for the purpose of maintaining 70% of advance payments collected from the home buyers.

- Nodal or escrow accounts of payment aggregators/prepaid payment instrument issuers for specific activities as permitted by Department of Payments and Settlement Systems (DPSS), Reserve Bank of India under Payment and Settlement Systems Act, 2007.

- Accounts for settlement of dues related to debit card/ATM card/credit card issuers/acquirers.

- Accounts permitted under FEMA, 1999.

- Accounts for the purpose of IPO / NFO /FPO/ share buyback /dividend payment / issuance of commercial papers/allotment of debentures/gratuity, etc. which are mandated by respective statutes or regulators and are meant for specific/limited transactions only.

- Accounts for payment of taxes, duties, statutory dues, etc. opened with banks authorized to collect the same, for borrowers of such banks which are not authorized to collect such taxes, duties, statutory dues, etc

- Accounts of White Label ATM Operators and their agents for sourcing of currency.

Please get in touch with our Client Services Team at (csd_mumbai@asia.bnpparibas.com / csd_delhi@asia.bnpparibas.com) or your Transaction Banking Sales Manager for any further information in this regard

Beware of Fictitious Offer of Prize / Lottery / Money Tranfers from Abroad – Message from the Reserve Bank of India

RBI Circular Regarding Remittance (915 ko)

Remittance Towards Lottery (92 ko)

RBI Circular regarding Guidelines for Appointment of Statutory Central Auditors

BNP Paribas – Policy for appointment of Statutory Auditors

IBA Circular

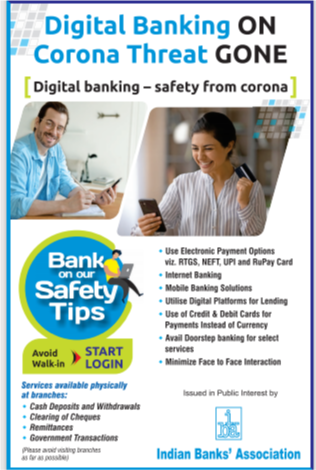

Circular on Covid-19 – Help Each Other, Help India

Circular regarding increase in deposit insurance from 1 lac to 5 lacs

Circular to member banks about the availability of uninterrupted banking services and precautionary measures while visiting the branches of the bank – below are the ads published in English and Hindi

Unclaimed Deposit Claim Format

Consumer Protection and Awareness – Cyber Safety and hygiene

Report Cyber Crime Online: National Cyber Crime Reporting portal is an initiative of the Government of India to facilitate reporting of cybercrime complaints online. For Filing a Complaint on the National Cyber Crime Reporting Portal, you may use the link below: https://cybercrime.gov.in.

In case of cyber financial fraud, for immediate reporting, you may call the National Cyber Crime Helpline at 1930.

Customer Education Literature Document – Click here for more details.

Working Capital Facility Letter