Listed Equities, Equity & Currency Derivatives – BNP Paribas Securities India Private Limited – Institutional business

Business Summary

- BNP Paribas Securities India Private Limited is a full service brokerage house providing Equity Research, Sales, Trading, Execution & Derivatives Clearing services.

- Empaneled with major foreign and domestic institutional investors such as Hedge funds, Sovereign Wealth Funds, Mutual Funds and Insurance Players.

- Strong and seasoned research set-up with in-depth coverage across major sectors:

- At the global level, BNP Paribas SA acquired Exane SA, as part of the expansion of our global Cash Equity franchise. Following the acquisition of Exane SA by BNP Paribas on 13th July, 2021, BNP Paribas launched an integration of the entities of the Exane group into the BNP Paribas Group (“the Group”). This integration process was finalized on 1st November 2023 with the merger of Exane SA within BNP Paribas. Our research product is now branded as BNP Paribas Exane.

- India research is now fully integrated into the BNP Paribas Exane research platform viz. BNP Paribas Exane CUBE, with effect from 30th November, 2023. Specifically, all Indian stocks under coverage have been migrated on to the BNP Paribas Exane template and are now available on CUBE. This achievement marks the first significant milestone in the expansion of the Group’s industry-leading research offering into Asia Pacific, which will become a core component of its global offering.

- Onshore sales supported by global and regional sales teams, distributing the India offering.

- Dedicated client service team

- Awarded top performer in the institutional equities segment in 2021-22, 2022-23 and 2023-24 by the BSE

- Awarded top-3 derivatives houses in India on 25th anniversary of the NSE

Terms and Conditions for research issuing entities

SEBI Investor Charter:

Stockbrokers Research issuing entities

Segregation and monitoring of collateral at client level

In order to further strengthen the mechanism of protection of client collateral from (i) misappropriation/misuse by Trading Member (“TM”) / Clearing Member (“CM”) and (ii) default of TM/CM and/or other clients, SEBI, NSE and BSE have laid down the framework for segregation and monitoring of collateral at client level. Refer NCL circular nos. NCL/CMPL/49348 dated 20th August, 2021, NCL/CMPL/49640 dated 17th September, 2021 and NCL/CMPL/49764 dated 29th September, 2021 on the captioned subject.

As per Para 4 of the SEBI circular SEBI | Segregation and Monitoring of Collateral at Client Level, with a view to provide visibility of client-wise collateral (for each client) at all levels, viz., TM, CM and Clearing Corporation (CC), a reporting mechanism, covering both cash and non-cash collaterals must be specified by the Clearing Corporations. In order to view the collateral details, NSE Clearing Ltd. (“NCL”) has provided a link for registration and viewing the collateral data on its website: Welcome (nseindia.com).

Client complaints

At BNP Paribas Securities India Private Limited, we strive to provide our clients with the highest possible standards in service. If for any reason you are not entirely satisfied with our service, products or employees, please let us know. We value your feedback and endeavor to resolve your complaints fairly.

Whom to contact:

Your assigned Relationship Manager, Desk Head or usual contact person; or our customer care mailbox

customercare_secindia@asia.bnpparibas.com

What is the process?

When we receive your complaint, we shall write to you to acknowledge your complaint within 10 business days upon receipt. We shall review your complaint and investigate your concerns. We shall provide a written interim and/or final response within 15 calendar days from the date of receipt. For certain cases, more time may be required for us to conduct the investigation.

For complaints regarding the research activity, we shall endeavour to resolve grievances within 7 (seven) business working days or such timelines as may be specified by SEBI under the SEBI (Research Analysts) Regulations, 2014.

If you have additional information or documents regarding your complaint, please provide them to us to assist in our investigation.

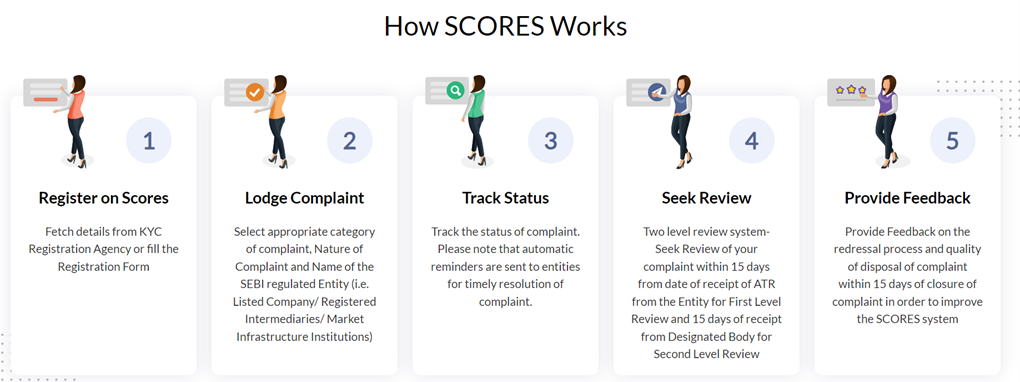

SEBI Complaints Redress System (SCORES) platform

Filing of complaints on SCORES – Easy & quick

a. Register on SCORES portal (https://scores.sebi.gov.in/)

b. Mandatory details for filing complaints on SCORES:

- Name, PAN, Address, Mobile Number, Email ID

c. Benefits:

- Effective communication

- Speedy redressal of the grievances

SMART ODR Portal

The new SMART ODR Portal (Securities Market Approach for Resolution Through ODR Portal) platform is designed to enhance investor grievance redressal by enabling investors to access Online Dispute Resolution Institutions for the resolution of their complaints.

Attention Investors

Prevent unauthorised transactions in your account –> Update your mobile numbers/e-mail IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/e-mail at the end of the day – Issued in the interest of Investors.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the research issuing entity or provide any assurance of returns to investors.

Social media

BNP Paribas Securities India Private Limited and its spokespersons are not affiliated with any social media groups or platforms that solicit stock advisory services or provide recommendations on buying or selling securities. Any such activity is unauthorised and does not represent the views or services of BNP Paribas Securities India Private Limited.

If you encounter any social media posts or groups purporting to offer stock advisory services on behalf of BNP Paribas Securities India Private Limited or its representatives, please disregard these communications and report these to us immediately at dl.indiabnppsecuritiescompliance@asia.bnpparibas.com

SEBI Risk Disclosure on Derivatives

- 9 out of 10 individual traders in equity Futures and Options Segment, incurred net losses.

- On an average, loss makers registered net trading loss close to ₹ 50,000.

- Over and above the net trading losses incurred, loss makers expended an additional 28% of net trading losses as transaction costs.

- Those making net trading profits, incurred between 15% to 50% of such profits as transaction cost.

Basic details of the stockbroker

Investor Grievances escalation matrix

Names and contact details of all Key Managerial Personnel including the Compliance Officer

Investor complaints data – monthly disclosure

Data for the month ending 30 June 2025

| Sr. no. | Received From | Carried forward from previous month/Pending at the end of last month | Received during the month | Resolved* | Total Pending# | Pending at the end of the month (Pending for <= 3 months) | Pending at the end of the month (Pending for > 3 months) | Average Resolution time^ (in days) |

| 1 | 2 | 3 | 4 | 5 | 6 | 7.1 | 7.2 | 8 |

| 1 | Directly from investors | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 2 | SEBI (SCORES 2.0) | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 3 | Stock exchanges | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| 4 | Other sources (if any) | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Number of complaints received during the month against the research issuing entity (“RA”) due to impersonation by some other entity: NIL

Note: In case of any complaints received against the RA due to impersonation of the RA by some other entity, the RA may adjust the number of such complaints from the total number of received / resolved complaints while preparing the above table. Further, the RA must close such impersonation related complaints after following the due process as specified by SEBI/BSE-RAASB.

*Inclusive of complaints of previous months resolved in the current month, if any.

#Inclusive of total complaints pending as on the last day of the month, if any.

^Average Resolution time is the sum total of time taken to resolve each complaint in days, in the current month divided by total number of complaints resolved in the current month.

Trend of monthly disposal of client complaints

| Sr. No. | Month | Carried forward from previous month | Received | Resolved* | Pending# |

| 1 | April, 2023 | 0 | 0 | 0 | 0 |

| 2 | May, 2023 | 0 | 0 | 0 | 0 |

| 3 | June, 2023 | 0 | 0 | 0 | 0 |

| 4 | July, 2023 | 0 | 0 | 0 | 0 |

| 5 | August, 2023 | 0 | 0 | 0 | 0 |

| 6 | September, 2023 | 0 | 0 | 0 | 0 |

| 7 | October, 2023 | 0 | 0 | 0 | 0 |

| 8 | November, 2023 | 0 | 0 | 0 | 0 |

| 9 | December, 2023 | 0 | 0 | 0 | 0 |

| 10 | January 2024 | 0 | 0 | 0 | 0 |

| 11 | February 2024 | 0 | 0 | 0 | 0 |

| 12 | March 2024 | 0 | 0 | 0 | 0 |

| 13 | April 2024 | 0 | 0 | 0 | 0 |

| 14 | May 2024 | 0 | 0 | 0 | 0 |

| 15 | June 2024 | 0 | 0 | 0 | 0 |

| 16 | July 2024 | 0 | 0 | 0 | 0 |

| 17 | August 2024 | 0 | 0 | 0 | 0 |

| 18 | September 2024 | 0 | 0 | 0 | 0 |

| 19 | October 2024 | 0 | 0 | 0 | 0 |

| 20 | November 2024 | 0 | 0 | 0 | 0 |

| 21 | December 2024 | 0 | 0 | 0 | 0 |

| 22 | January 2025 | 0 | 0 | 0 | 0 |

| 23 | February 2025 | 0 | 0 | 0 | 0 |

| 24 | March 2025 | 0 | 0 | 0 | 0 |

| 25 | April 2025 | 0 | 0 | 0 | 0 |

| 26 | May 2025 | 0 | 0 | 0 | 0 |

| 27 | June 2025 | 0 | 0 | 0 | 0 |

| Grand Total | 0 | 0 | 0 | 0 |

*Inclusive of complaints of previous months resolved in the current month.

#Inclusive of complaints pending as on the last day of the month.

Trend of annual disposal of client complaints

| SN | Year | Carried forward from previous year | Received during the year | Resolved during the year* | Pending at the end of the year# |

| 1 | 2017-18 | 0 | 0 | 0 | 0 |

| 2 | 2018-19 | 0 | 0 | 0 | 0 |

| 3 | 2019-20 | 0 | 1 | 1 | 0 |

| 4 | 2020-21 | 0 | 0 | 0 | 0 |

| 5 | 2021-22 | 0 | 0 | 0 | 0 |

| 6 | 2022-23 | 0 | 0 | 0 | 0 |

| 7 | 2023-24 | 0 | 0 | 0 | 0 |

| 8 | 2024 – 25 | 0 | 0 | 0 | 0 |

* Inclusive of complaints of previous years resolved in the current year

#Inclusive of complaints pending as on the last day of the year

Designated client bank accounts

Investors are requested to note that BNP Paribas Securities India Private Limited is permitted to receive money from investors through designated bank accounts only, named as Up streaming Client Nodal Bank Accounts (USCNBA). BNP Paribas Securities India Private Limited is also required to disclose these USCNB accounts to the stock exchanges. Hence, you are requested to use the following USCNB accounts only, for the purpose of dealings in your trading account with us. The details of these USCNB accounts are also displayed by the stock exchanges on their websites under “Know/Locate your Stock Broker” (NSE) or “Member Directory” (BSE).

| Sr. no. | Bank name | Name of the account | Bank account number | IFSC code |

| 1 | Axis Bank | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 913020014081441 | UTIB0000004 |

| 2 | BNP PARIBAS | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 0900911579500119 | BNPA0009009 |

| 3 | BNP PARIBAS | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 0900911579600110 | BNPA0009009 |

| 4 | BNP PARIBAS | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 0900911719500129 | BNPA0009009 |

| 5 | BNP PARIBAS | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 0900911803400144 | BNPA0009009 |

| 6 | HDFC Bank | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 00600340083245 | HDFC0000060 |

| 7 | HSBC | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 006226435001 | HSBC01INDIA |

| 8 | ICICI Bank | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 000405123641 | ICIC0000004 |

| 9 | Standard Chartered Bank | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 22105113251 | SCBL0036085 |

| 10 | Standard Chartered Bank | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 22105113278 | SCBL0036085 |

| 11 | Standard Chartered Bank | BNP PARIBAS SECURITIES INDIA PVT LTD – USCNB ACCOUNT | 22105113286 | SCBL0036085 |

For custodian settled trades, the settlement process will continue as per regulatory requirements.